In the realm of finance, the question of how political leadership influences stock market performance has long been a matter of both fascination and contention. As the nation gears up for the impending 2024 presidential election, investors are turning to historical data in search of insights into potential market trajectories under different political administrations. However, beneath the surface of partisan debates lies a nuanced reality that defies simple categorization.

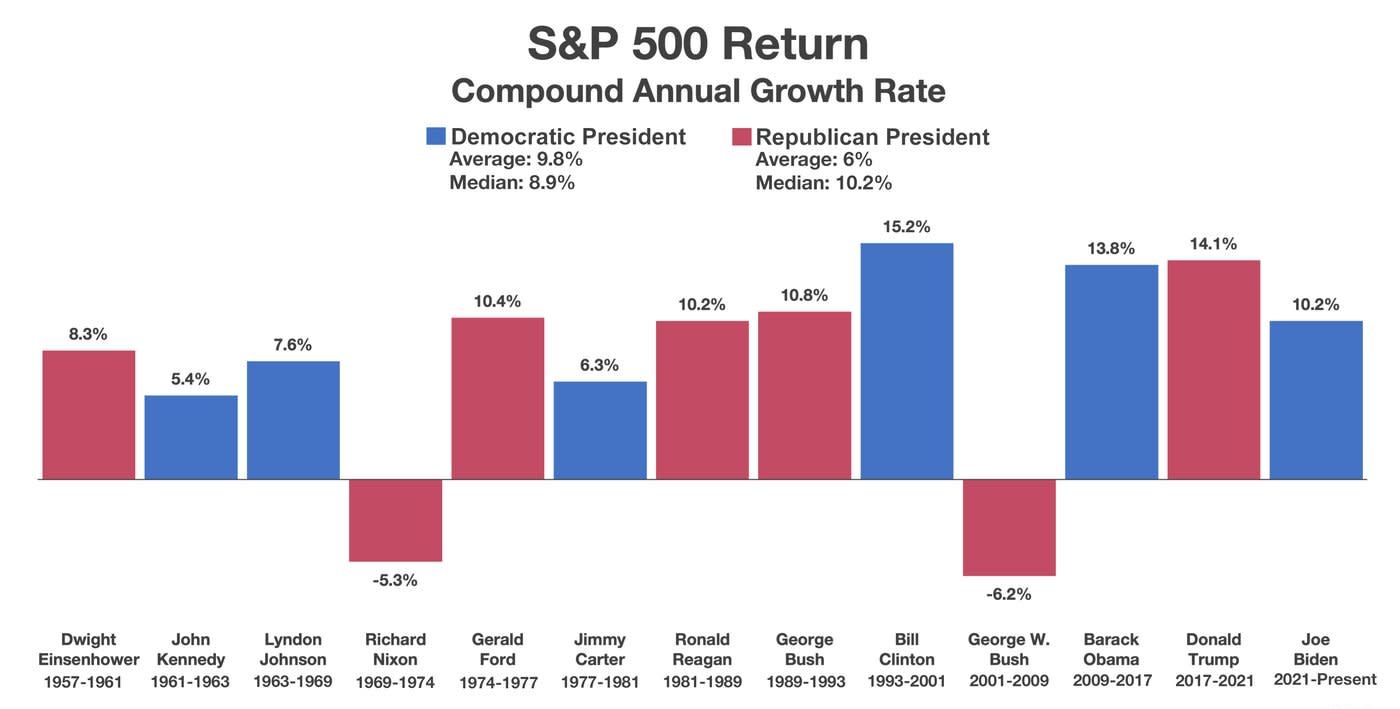

Deciphering the Data: Recent analysis of the S&P 500’s historical performance since its inception in 1957 provides valuable context for understanding stock market returns under Democratic and Republican presidents. The findings reveal intriguing trends: while the average Compound Annual Growth Rate (CAGR) stands at 9.8% under Democratic leadership, it drops to 6% under Republican rule. However, a closer examination of median CAGR figures presents a more nuanced picture, with rates of 8.9% under Democrats and 10.2% under Republicans. These statistics underscore the complexities of market dynamics, challenging conventional partisan narratives.

Deciphering the Data: Recent analysis of the S&P 500’s historical performance since its inception in 1957 provides valuable context for understanding stock market returns under Democratic and Republican presidents. The findings reveal intriguing trends: while the average Compound Annual Growth Rate (CAGR) stands at 9.8% under Democratic leadership, it drops to 6% under Republican rule. However, a closer examination of median CAGR figures presents a more nuanced picture, with rates of 8.9% under Democrats and 10.2% under Republicans. These statistics underscore the complexities of market dynamics, challenging conventional partisan narratives.

Navigating the Numbers: Delving further into the data, analysis of the average annual growth rate (AAGR) under different presidential terms offers additional insights. Notably, the S&P 500 experienced an 11.4% AAGR under Democratic administrations, compared to 7% under Republicans. Yet, experts caution against drawing hasty conclusions, highlighting the limitations of AAGR in fully capturing the intricacies of market performance.

A Pragmatic Approach: While political actors often lay claim to economic successes during their tenures, the reality is far more nuanced. Historical events such as the dot-com bubble, the Great Recession, and the COVID-19 pandemic serve as stark reminders of the myriad external factors that shape market dynamics. These episodes underscore the importance of viewing market performance through a holistic lens, one that transcends the narrow confines of partisan politics.

Investment Wisdom: Amid the noise of political rhetoric, investors are wise to anchor their decisions in fundamental principles rather than political conjecture. Focusing on metrics such as revenue and earnings growth offers a more reliable compass for navigating market volatility. By adopting a disciplined investment approach grounded in economic fundamentals, investors can weather the storm of political uncertainty with resilience and prudence.

Charting a Course Forward: As the nation stands on the cusp of another electoral cycle, investors would do well to heed the lessons of history while maintaining a forward-looking perspective. While political administrations undoubtedly shape the economic landscape, the enduring principles of sound investing remain steadfast. By embracing a nuanced understanding of market dynamics and eschewing the pitfalls of partisan polarization, investors can position themselves for long-term success in an ever-changing economic environment.